ICBC Backs Down on Potential Limitation Period Showdown With Crash Victims – BC INJURY LAW

BC’s car or truck coverage landscape is at the moment in a mess. There is a Civil Resolution Tribunal that may perhaps be unconstitutional. Some crash victims nonetheless have the right to sue the at fault motorist that injured them. Some are caught in a period of time in which they can nonetheless sue but deceptively labelled ‘minor injuries’ have capped damages. The constitutionality of that law is becoming questioned in ongoing litigation. Some crash victims have no ideal to sue at all. The constitutionality of that legislation is getting questioned. Apparent as mud?

Matters are, in a phrase, complicated.

One complexity now has a bit far more clarity. This is not east to clarify succinctly but permit me give it a shot.

Crash victims immediately after April 2019 – May 2021 have the appropriate to sue. They can get suffering and suffering. If their accidents are deemed ‘minor’ their pain and struggling is capped at about $5,500. If the target sues in BC Supreme Court and the at fault motorist (almost normally insured by ICBC) claims the accidents are minimal they can look for an application that the assert be diverted to the Civil Resolution Tribunal.

For the reason that of the pandemic there has in essence been a a single yr extension of the time restrict to sue in BC Supreme Court docket. The BC Civil Resolution Tribunal gave no these courtesy. So in limited a crash target can sue in time in BC Supreme Court docket, ICBC can hypothetically search for to dismiss the lawsuit and question that it be ordered to be restarted at the CRT. If a court docket grants these types of an buy the sufferer only has a couple weeks to commence the continuing there. But what if the assert is outside of two many years at the time this happens (the typical limitation period)? Can they refile in the CRT or are they out of time? The BC Federal government, in all their attempts to stack the deck of the vehicle insurance policy process in ICBC’s favour, did not trouble clarifying this. It is unclear what the greatest outcome would be (though there are robust arguments as to why the re-filing ought to be allowed, I’ll save those people for an additional working day).

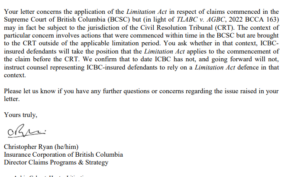

ICBC has made the decision to back again down and not increase this problem. A letter was despatched by counsel for ICBC to counsel for plaintiffs in some of the ongoing constitutional difficulties the place the Crown Company agreed to back down. I’ll let the letter speak for alone. Particularly ICBC’s Director Promises Programs & Method suggests that

“The context of distinct worry will involve actions that were being commenced in time in the BCSC but are brought

to the CRT exterior of the applicable limitation period. You request no matter whether in that context, ICBC insured defendants will consider the situation that the Limitation Act applies to the graduation of the assert prior to the CRT. We validate that to date ICBC has not, and likely forward will not,

instruct counsel representing ICBC-insured defendants to count on a Limitation Act defence in that context. ”

A small little bit of clarity in a brutally advanced authorized landscape.