New Law Alterations Desire Level Assumptions for Existence Insurance coverage

The the latest appropriations invoice (H.R. 133) and COVID-19 relief provisions, signed into law on Dec. 27, 2020, integrated a major transform to the curiosity level assumptions underlying Internal Revenue Code Area 7702. These interest premiums present the parameters for a agreement to qualify as a everyday living insurance plan coverage for income tax uses. The result will be to improve the volume of high quality that can be deposited into a everyday living insurance policy for a given quantity of mortality hazard that’s involved in the policy agreement. The transform in the IRC Section 7702 interest amount assumptions is applicable to lifestyle insurance guidelines issued on or just after Jan. 1, 2021.

A lifestyle insurance coverage plan structured to receive optimal earnings tax remedy (referred to as a non-modified endowment deal) consists of the adhering to unique established of characteristics:

- Investment returns within just the everyday living insurance policies policy are deferred from present-day period cash flow tax(IRC Sections 72(e) and 7702(a)-(g)).

- The proprietor can just take distributions of somewhere around 85% – 90% of the existence insurance policies coverage benefit on a tax-no cost foundation at any time (IRC Segment 72(e)(5)(A)-(C)).

- The deferred taxes are removed altogether at the loss of life of the insured (IRC Portion 101(a)(1)).

For PPLI procedures, which are typically structured to include things like only the bare minimum sum of mortality possibility desired to realize exceptional income tax remedy, the adjust in the Section 7702 fascination amount assumptions will travel two pretty favorable results:

1. Raise in top quality deposit ability: An improve in the complete quality deposit capacity for every single individual that can be insured by means of a portfolio of PPLI policies, and

2. Reduce price: A reduction in drag on return prompted by mortality expense, and a corresponding raise in the investment account benefit that can be accumulated inside a PPLI policy for each individual top quality deposit.

How it Performs and What’s Transforming

Below Area 7702, a PPLI plan will be taken care of as a “life coverage contract” for cash flow tax purposes if it satisfies: (1) the income worth accumulation test (CVAT) less than Portion 7702(b) or (2) the guideline quality test and cash worth corridor check (GPT) beneath Section 7702(c). The two the CVAT and GPT have been built based mostly on a uncomplicated principal: the utmost quantity of high quality or the optimum total of dollars worth permitted for a daily life insurance policies plan ought to be capped at the amount of money essential to guarantee that the plan will endow at the coverage maturity day even if the daily life insurance coverage company delivers only the functionality which is assured underneath the policy agreement.

A PPLI policy will fulfill the CVAT if the cash surrender price of the policy does not at any time exceed the internet one high quality demanded for the coverage to endow at the maturity day dependent on the policy’s guaranteed utmost mortality risk price and the permitted interest charge assumption. Prior to the enactment of H.R. 133, the minimal permitted fascination rate assumption for the CVAT calculation was 4%. For guidelines issued in 2021, the least permitted fascination price for the CVAT calculation is decreased to 2%. For guidelines issued in 2022 and thereafter, the minimum permitted curiosity price will be a floating charge.

A PPLI plan will fulfill the GPT if the top quality deposits do not exceed the larger of the Guideline Stage Premiums (GLPs) or the Guideline Single Quality (GSP) required for the plan to endow at the maturity day primarily based on the policy’s assured utmost mortality danger price, the policy’s guaranteed greatest administrative service fees and charges and the permitted fascination price assumption. In addition, the policy must satisfy the bare minimum internet sum at possibility prerequisite described under the statute (a ratio for which the numerator is the existence insurance policies proceeds payable at the death of the insured and the denominator is the coverage money surrender price) centered on the insured’s age.

- Prior to the enactment of H.R. 133, the permitted interest level assumption for the GSP calculation was 6%. For procedures issued in 2021, the minimum permitted fascination level for the GSP calculation is lowered to 4%. For procedures issued in 2022 and thereafter, the minimum amount permitted curiosity fee will be the floating GLP charge plus 2%.

- Prior to the enactment of H.R. 133, the least permitted interest level assumption for the GLPs calculation was 4%. For policies issued in 2021, the minimal permitted desire amount for the GLPs calculation is minimized to 2%. For policies issued in 2022 and thereafter, the minimum amount permitted fascination level will be a floating price.

In the long term, the Portion 7702 desire price assumptions will be modified at the outset of a calendar 12 months based mostly on the lesser of: (1) the fee recommended in the National Association of Insurance policy Commissioners’ Regular Valuation Law, or (2) the average mid-expression applicable federal charge over the 60-month interval that finishes two calendar many years prior to the adjustment 12 months. Whilst this language is complex, the timing is supposed to give the everyday living insurance policy providers adequate chance to alter their item capabilities and administrative programs to accommodate the changing interest charge assumptions. After altered, the new Part 7702 curiosity level assumptions will be relevant for each and every PPLI plan issued in the course of the calendar yr. On top of that, the Segment 7702 curiosity charge assumption applicable when a PPLI coverage is issued will normally remain in result for the complete time that PPLI coverage exists.

Raise in Premium Deposit Potential

The quantity of high quality that HNW family members are permitted to deposit into tax-optimized PPLI insurance policies can be constrained by the overall amount of money of mortality threat that can be aggregated by life insurance policy providers and their reinsurers. The premium deposit for any insured is constrained by this overall mortality possibility limitation and might be more constrained by the total of protection that can be underwritten financially (dependent on that insured’s money standing). The expansion of top quality deposit capacity will help many HNW people to boost the part of their financial commitment portfolio that can be shielded from revenue tax by way of the use of PPLI guidelines.

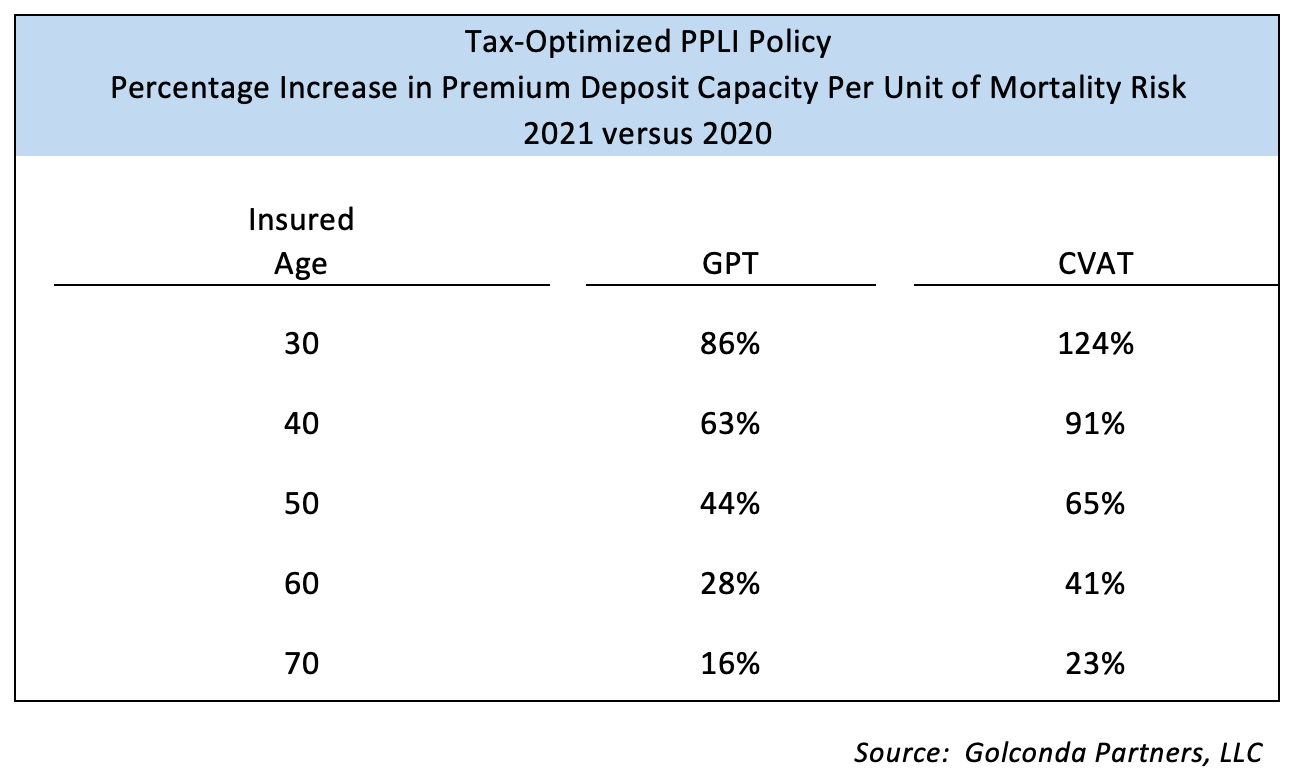

The percentage boost in top quality deposit capability for a tax-optimized PPLI coverage acquired in 2021 will be a purpose of the age of the insured individual. The younger the insured individual, the increased the impression of the modify in Area 7702 fascination charge assumptions.

Lower Expense

In most situation, a PPLI policy will be structured with the bare minimum amount of mortality danger expected under Section 7702, simply because that composition enables an optimization of earnings tax results at the most affordable charge. The transform to the Portion 7702 fascination rate assumptions will enable PPLI procedures issued in 2021 to attain tax-optimization with decreased quantities of mortality possibility. The reduction in mortality hazard will generate a corresponding reduction in the mortality cost component of the PPLI coverage, resulting in a decreased drag on the financial commitment account return each individual 12 months. The web influence will be an enhanced efficiency and increased accumulation of benefit in the coverage investment accounts.

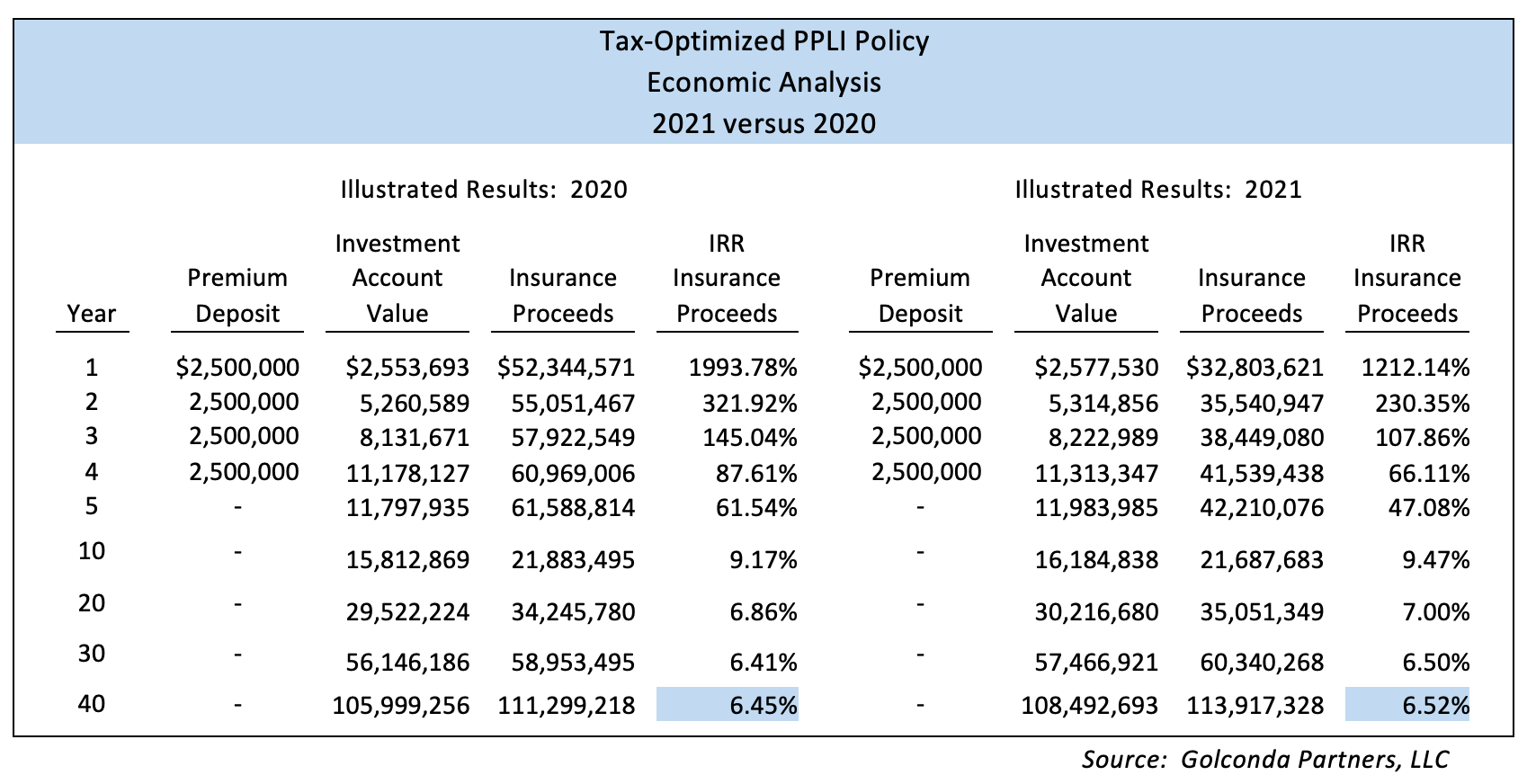

The desk underneath compares the illustrated success for a tax-optimized PPLI policy that is structured to acknowledge $10 million of cumulative premium deposits over 4 several years, insures the daily life of a 50-calendar year-old Male, and is assumed to receive a 7% return, internet of expenditure management charges:

Tipping the Scales

The alter to the Segment 7702 curiosity assumptions will have a constructive impression on PPLI policy high quality deposit capability and efficiency and must result in an maximize in demand among HNW people.

In addition, there is is a strong likelihood that Congress will enact laws in 2021 to raise earnings tax rates and decrease estate and reward exemption amounts for HNW households. If that comes about, the mixture of greater high quality deposit capacity and reduced cost for PPLI guidelines could idea the scales for households that have been thinking of the acquisition of PPLI guidelines but haven’t nonetheless taken motion.

Michael Liebeskind is the founder of Golconda Partners, LLC, and Bryan Bloom is a tax companion at Faegre Drinker Biddle & Reath LLP.

The authors desire to specific their gratitude to Gabe Schiminovich for his help with the preparation of this write-up.