Eastman Kodak: With The Politics Over, It’s Not Worth It (NYSE:KODK)

wellesenterprises/iStock Editorial through Getty Illustrations or photos

Politics

As I’ve talked over listed here before, a few of periods, you will find been a specified amount of money of political pleasure regarding Eastman Kodak (NYSE: KODK). The Trump Administration, the Protection Output Act, a huge mortgage to Kodak to make the precursor chemical compounds for different pharmaceuticals. Then the improve of administration, varied hemming, and hawing about the personal loan. Management dumping inventory into charitable foundations at the peak. The personal loan not coming by of program.

As an concept in the 1st place, it was somewhat odd. Of course, guaranteed, chemistry is chemistry, but there are really unique traces in chemistry. Possibly only politics could feel that “Hey, it’s all just chemistry, ideal?” is the way to allocate funds to develop a prescribed drugs source pipeline.

In any case, which is all over and performed and long gone with.

Which leaves Eastman Kodak as it is now

That first images company got eaten by technological improve. Ah properly, that transpires. So, what is actually still left? Other than a manufacturer title to die for that is?

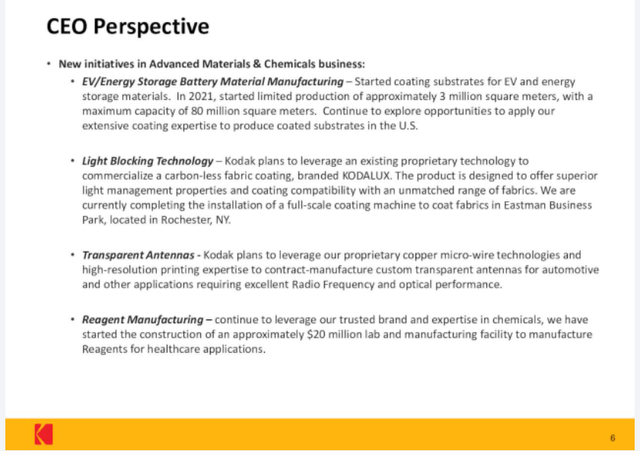

Properly, there are even now a couple achievable products and solutions from the aged exploration labs which the corporation owns. There could be some thing in there. What the management thinks there could possibly be is as follows:

Kodak systems (Kodak administration presentation by way of Trying to get Alpha)

The thing about these is that they’re all flawlessly respectable alternatives. Positive, some of them may possibly do the job, some many others not. We don’t know, as with any rollout of a new tech. But what we do know about them is that none are world-transforming technological possibilities. Completely respectable they could be, but none are about to established the planet alight – even if they realize success. They are just not in the proper sectors to be that.

This does make a selected sense as they are those people techs which had been in the investigate labs but not picked up when Kodak was in its pomp. Even the outdated administration would have experienced a improved than even chance of striving some thing that could possibly actually generate a mass market place.

Finances

Sure, Kodak’s acquired the assets to be capable to bring one particular or additional of these to maturity. Q1 is listed here in temporary. Income is nevertheless a quarter billion a quarter, there is hard cash in the bank. Losses are workable. They’re not about to go to zero – they could possibly around time but they’re not about to.

But

Effectively, Kodak is now a quite center-ranking corporate with a number of possibly exciting tips stemming from the outdated know-how in printing (transparent antennae and substrate coating are variations on printing, for instance) but none of those people strategies or even sectors are about to set the earth alight. In which there could be a decent-sized industry – substrates say – there’s a good deal of competition, so margins will always be limited.

There’s absolutely nothing erroneous with any of this. Apart from for this: “PE (TTM) 137.84”. The future’s not just fascinating adequate to be valuing Kodak at that multiple of recent (or even the latest previous) earnings. That transformational offer together with the bank loan did not come about. Yet, we feel to have a hangover for the equity valuation which even now involves some notion that there is a transformational deal either occurring or imminent.

I you should not see it. I do see a perfectly respectable enterprise that could crop up from these ashes. Very well, you know, it’s possible and potentially. But practically nothing that is really worth 137 moments current earnings.

Guaranteed and this is brusque

I have not delved deep into the facts of earnings and so on just due to the fact I do not believe that’s vital to sort a watch. As I’ve said now, it could nicely be that a person or much more of these systems “functions” in the perception of staying financially rewarding. But none of them are going to be – probably most likely to be – at the type of scale that justifies a PE of 137. That implies that Kodak is at the moment overvalued.

I extraordinarily seldom advise shorting a inventory just for the reason that it does not look that the challenges are practical for the unique investor. So, I’m not heading listed here. I’m sure there will be twists and turns in the Kodak story and maybe even in the stock price. But I simply cannot see anything at all in this article that supports the extremely superior PE. Therefore, my expectation is that the rate will drop.

My see

Kodak simply just is not really worth what the market place at the moment selling prices it at. So, at best, offer and spend elsewhere. I could be wrong, of system, I could, perhaps a single of these technologies is about to storm the planet. But I truly don’t feel so, there’s not that capacity to scale there.

The investor perspective

Redeploy funds absent from Kodak. It can be real that if that mortgage had appear by means of then that would have been transformative. It didn’t, it’s not likely to now, but the inventory selling price is nonetheless buoyed by the pleasure more than the strategy. Time to just take the hard cash out and shift on to a little something else, this isn’t going to come correct.